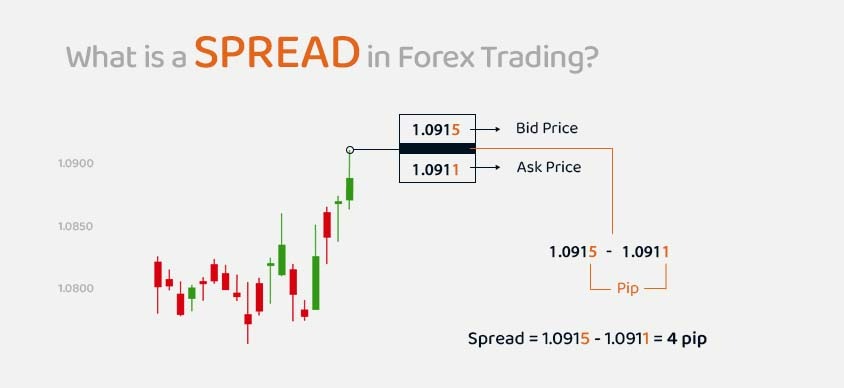

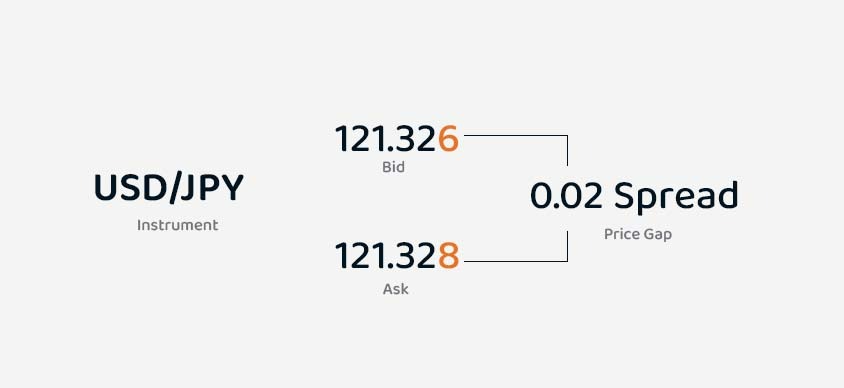

A Currency Pair will be quoted at two distinct values by Forex Brokers. The Price of the Bid and the Price of the Ask . The "Bid" is Selling Price. The "Ask" is Buying Price.The difference between these two prices is referred to as SPREAD.

| Instrument | Connexar STD | Connexar ECN | Connexar PRO |

|---|---|---|---|

| Euro VS US Dollar | 1.9 | 1.1 | 1.8 |

| British Pound VS US Dollar | 2.2 | 1.4 | 2.1 |

| US Dollar VS Japan Yen | 2.1 | 1.3 | 2 |

| US Dollar VS Swiss Franc | 2.4 | 1.6 | 2.3 |

A Currency Pair will be quoted at two distinct values by Forex Brokers. The Price of the Bid and the Price of the Ask . The "Bid" is Selling Price. The "Ask" is Buying Price.The difference between these two prices is referred to as SPREAD.

Above spreads are variable, spreads may vary per instrument according to market conditions. The above spreads are quoted on average spreads taken from different time zones

In times of extreme volatility or illiquid market or bank holidays (during the time of FOMC meet / important economic calendar announcement /stock market open and close time/ any important financial event..etc), trades can feel the spread widen. This is not a factor specific to Connexar Capital clients, but across the whole financial market landscape, including all institutional and retail market participants.

Yes, you can change the account type any time you wish however, depending upon the equity requirement you can change the account type, please note that while changing the account type we request traders to close the open and pending orders and then give requests because this will reflect in leverage and spread, you can submit the request to support@connexarcapital.com or you can raise a request your client login page, within few business hours the change will be reflected.

Because of the ill-liquidity market, the spread will widen on trading holidays. We suggest traders keep sufficient margin during market holidays this will impact traders if they have an open position.

Tight spreads can help you make a profit quicker, ConneXar Capital also expects the same from trades, during the time of stock market presence traders can feel the tight spread, after the European market opens most of the active participants will be in the market where traders can feel the tight spread.