Check all types of forex-related FAQ sessions with connexar capital.

Click Here.

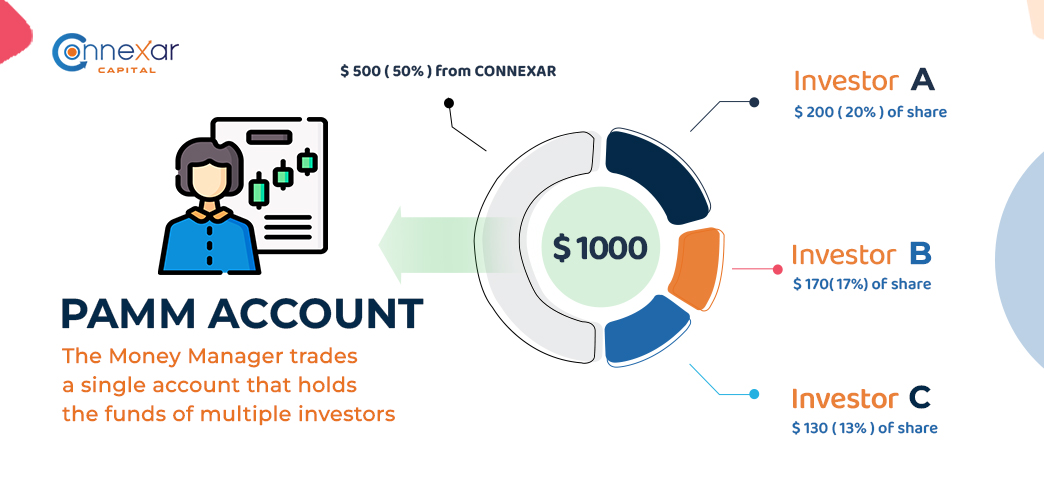

A PAMM (Percent Allocation Management Module or Percentage Allocation Money Management) account is a type of forex trading account offered by Connexar Capital Ltd that allows traders to invest in a portfolio of trades managed by an experienced trader, called a Money Manager.

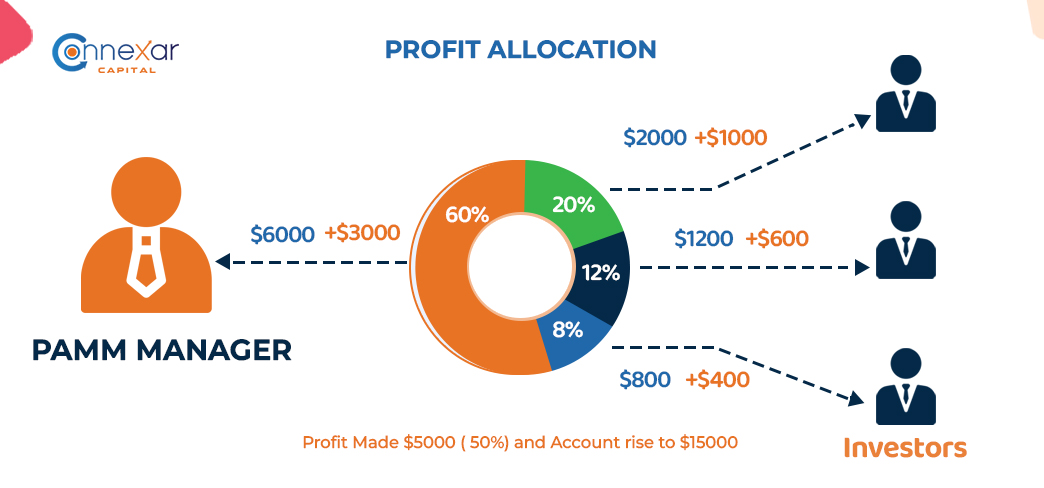

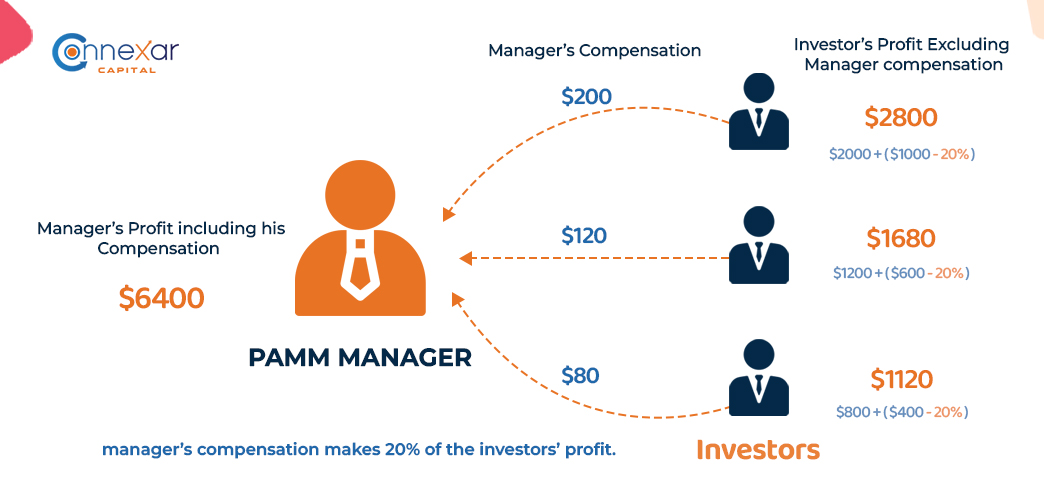

In a PAMM account, the Money Manager trades a single account that holds the funds of multiple investors, and the profits and losses are allocated among the investors based on their proportional investment.

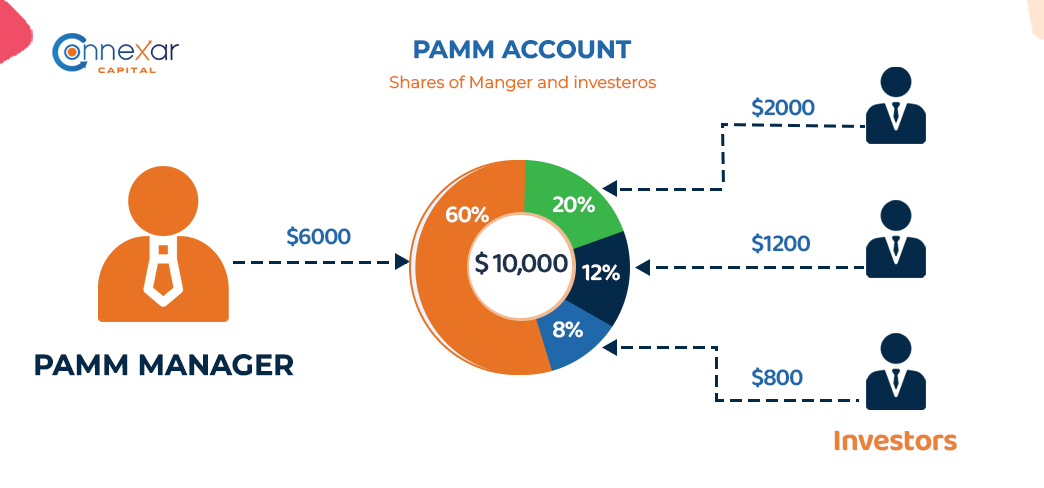

Note: Design the image based on the below Ex: $10,000

PAMM accounts can offer investors the opportunity to benefit from the expertise of experienced traders, without having to spend time and effort managing their own trades. However, it is important to note that investing in a PAMM account is not without risk, and investors should carefully consider the track record of the Money Manager and the terms and conditions/Read the FAQ of the account before investing.

Risk Management: Professional fund managers are responsible for managing the risk associated with PAMM accounts, and they typically employ a range of risk management techniques to protect investor capital.

No Trading Experience Required: PAMM accounts are designed for those who have limited or no experience in forex trading, as the fund manager will handle all aspects of trading.

Low Minimum Investment: PAMM accounts typically have a low minimum investment requirement, making it accessible to a wide range of investors.

Pooled Funds: PAMM accounts involve pooling funds from multiple investors, allowing for larger trades and potentially higher returns.

Note: It's important to note that PAMM accounts are not without risks, and investors should thoroughly research the fund manager and their track record before investing. Additionally, past performance is not a guarantee of future results, and there is always the risk of losing money in the forex market.