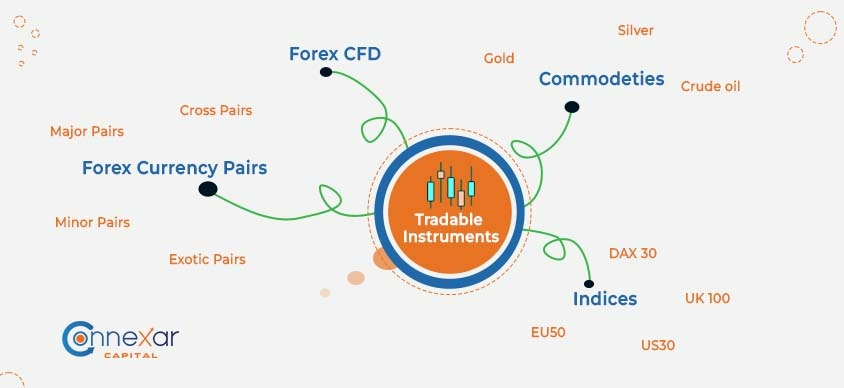

Trading instruments refer to the different types of markets you can trade. Sometimes called securities, they range from commodity futures to stocks and CFDs, to currencies and metals, and more. Currency can be traded through spot transactions, forwards, swaps and option contracts where the underlying instrument is a currency. Traders buy and sell multiple currency pairs within the same day, or even multiple times within a day, to take advantage of small market movements Connexar Capital provides a list of tradable instruments, which will be high class Fast Execution Instruments for clients, by Accessing the Global Markets 24 hours / 5 Days.

Copy trading is a method of investing in financial markets where traders can automatically copy the trades of other successful traders. In other words, investors can replicate the trades of experienced traders in real-time.

The process involves linking an investor's trading account to that of a successful trader, allowing the investor to automatically replicate the trades made by the trader. This can be done manually or through a dedicated copy trading ConnexarCapital Ltd, which can provide tools and analysis to help investors identify and select traders to follow.

Copy trading can be appealing to investors who lack the experience or knowledge to make informed investment decisions on their own, as it allows them to benefit from the expertise of more experienced traders.

| MAJOR PAIRS | |||

|---|---|---|---|

| EUR / USD | GBP / USD | USD / JPY | USD / CHF |

Currencies, indices & metals,are eligible for trading.

We offer variable spreads that can be as low as raw spread or 0.1 pips. We have no re-quoting: our clients are given directly the market price that our system receives. ConneXarCapital Ltd operates with variable spreads, just like the interbank forex market.

Yes, we do. You are free to hedge your positions on your trading account. Hedging takes place when you simultaneously open a LONG and a SHORT position on the same instrument.

When hedging Forex, Gold and Silver, positions can be opened even when the margin level is below 100%, because the margin requirement for hedged positions is zero.

When hedging all other instruments, margin requirement for the hedged position is equal to 50%. New hedged positions can be opened if the final margin requirements will be equal or less than the total equity of the account.

You can change the leverage under your client area login, Change Leverage Request and then submit the request.

Slippages hardly ever occur if you trade with us. Sometimes, however, especially when important economic news is released, due to a sharp rise/fall in the market price, your order may be filled at a different rate than you requested.

At ConneXarCapital Ltd, your orders are filled at the best available market price, which may be to your benefit.

Yes, we do. Clients who have a minimum trading account balance of 5000 USD (or equivalent currency) are eligible to request the free MT5 VPS in the Client Area at any given time on condition that they trade at least 5 standard round turn lots (or 500 micro round turn lots) per month.