22

February

How are Swap Charges calculated in the Forex Market?

Swap charges, also known as overnight financing fees or rollover fees, occur as a result of holding positions overnight in the forex or commodity markets. Here's how swap charges occur, Interest Rate Differential, Borrowing and Lending, Central Bank Policies, and Market Conditions

Understanding Swap Charges:

- Swap charges, also known as rollover fees or overnight financing fees, are costs or earnings associated with holding positions overnight in the forex or commodity markets.

- These charges are determined by the interest rate differentials between the currencies or commodities being traded.

Calculation Method:

- Swap charges are typically calculated based on the size of the position, the interest rate differentials, and the number of days the position is held.

- Formula: Swap Charges=[(Standard Lot)× (Pip Value×Rate)×(Current Swap Charges)×(Number of Days)] / 10

Real-time Examples:

- EURUSD: Consider a trader holding a long position in EURUSD (Euro against the US Dollar) overnight. If the Euro has a higher interest rate compared to the US Dollar, the trader may incur swap charges.

- Oil: For instance, an investor holding a long position in crude oil overnight may face swap charges if the interest rates associated with the currencies in the oil-producing countries differ.

- USDJPY: If a trader holds a long position in USDJPY (US Dollar against Japanese Yen), the swap charges would be influenced by the interest rate differentials between the US Dollar and the Japanese Yen.

- Gold: Investors holding positions in gold may experience swap charges due to interest rate disparities between the currencies associated with gold-producing countries.

- → USDJPY Rate = Long Swap Charges = +12.00,

- Short Swap Charges = -25.00

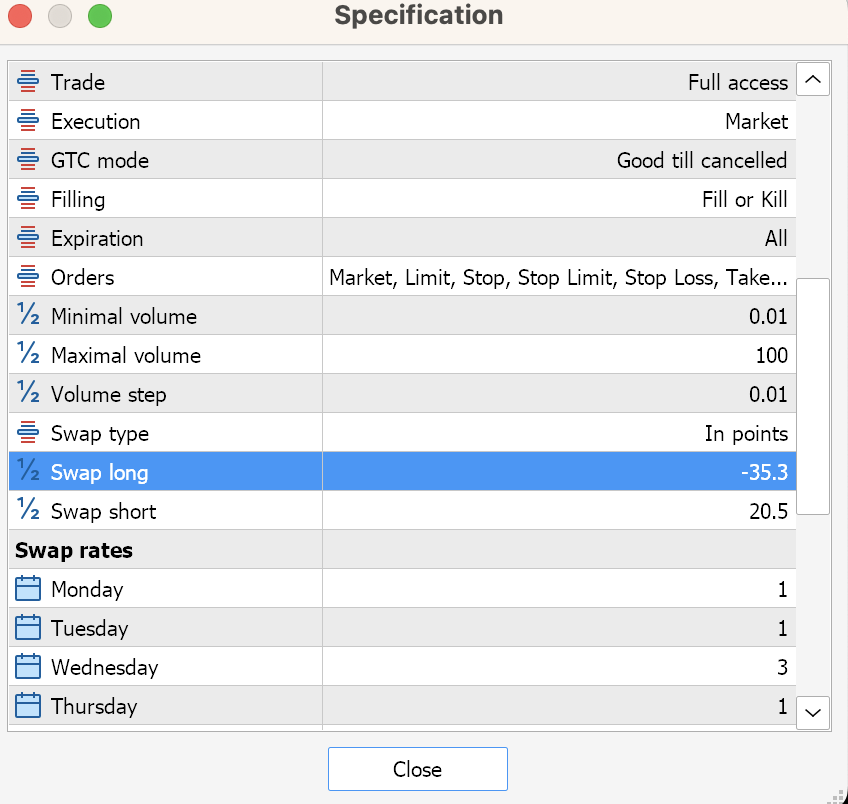

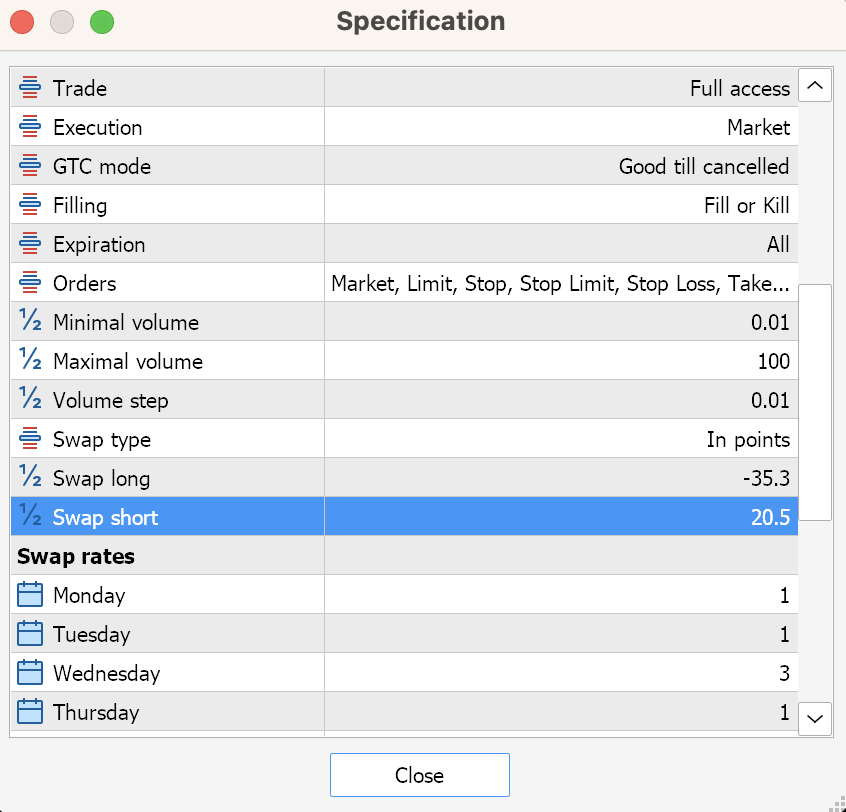

- → Gold Rate = Long Swap Charges = - 35.30,

- Short Swap Charges =+20.5

Swap Charges=(Volume*Pip Value *(Swap rate)*number of days) ÷ 10

- 1) Instrument: Gold

- Volume: 1.00 (standard volume) Pip Value: $10

- Long Swap Charges: -35.3 Number of Swap Days: 1

- Swap Charges=Volume*Pip Value *(Swap Rate)* number of days ÷ pip value= -35.3

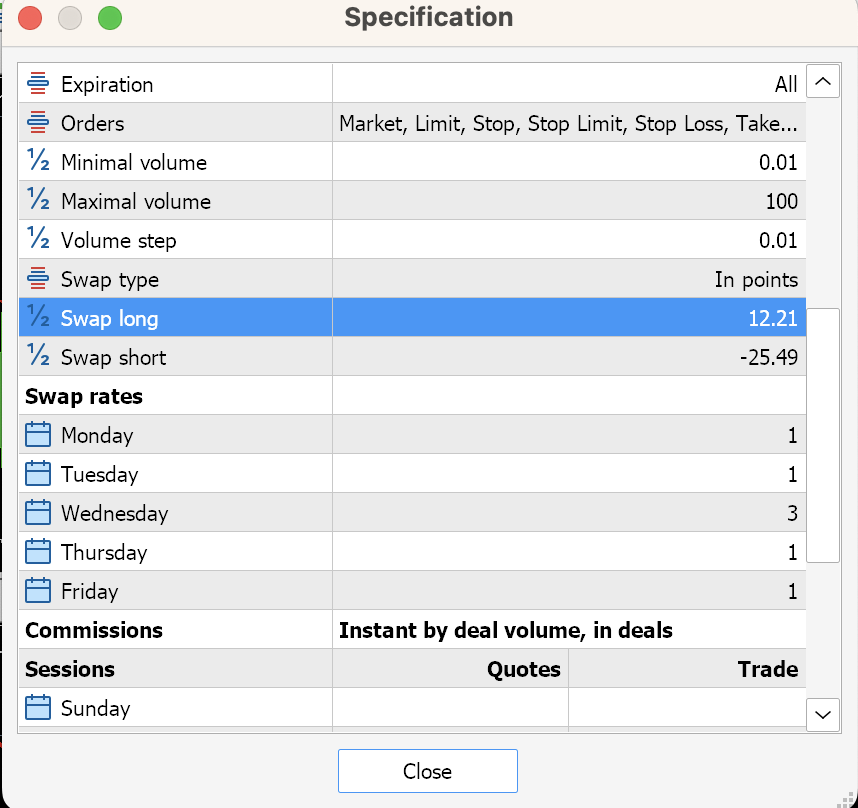

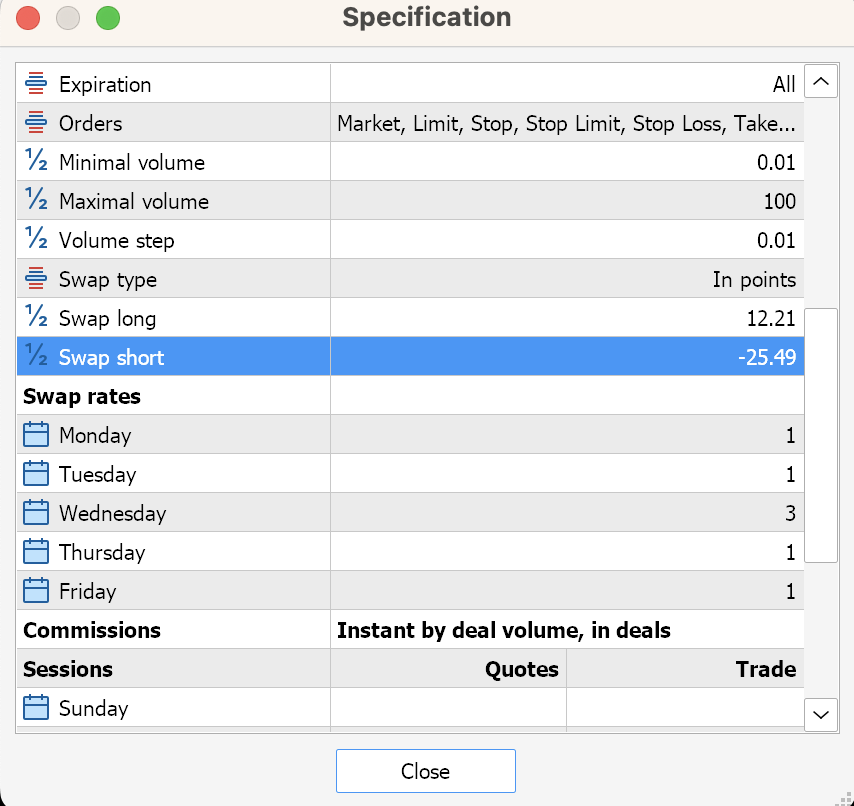

( Market Watch→ Symbols → Right Click → Specifications)

Swap Charges=1.00×10×(−35.3)×1÷10 = -$ 35.3

- 2) Instrument: Gold

- Volume: 1.00 (standard volume) Pip Value: $10

- Short Swap Charges: +20.5 Number of Swap Days: 1

Swap Charges= (Volume*Pip Value *(Swap Rate)* a number of days) ÷pip value = 20.5

Swap Charges=1.00×10×(20.5)×1÷10 = $ 20.5

3) Note: In the above example, the Gold per pip value is $1, but when it comes to differentiated pip value, the Swap charges might differ from what is shown in MT5 Specification ( Market Watch→ Symbols → Right Click → Specifications)

- Instrument: USDJPY

- Volume: 1.00 (standard volume)

- Pip Value: $6.67

- Long Swap Charges: +12.21

- Number of Swap Days: 1

- Swap Charges=Volume*Pip Value *(Swap Rate)* a number of days ÷ 10 => $8.14

Swap Charges=1.00×6.67×(12.21)×1÷10 = 8.14

Therefore overnight charges for holding USDJPY, Trader will get $8.14, not 12.21

- 4) Instrument: USDJPY

- Volume: 1.00 (standard volume)

- Pip Value: $6.67

- Short Swap Charges: -25.49

- Number of Swap Days: 1

- Swap Charges=Volume*Pip Value *(Swap Rate)* a number of days ÷ 10 = $17.00

Swap Charges=1.00×6.67×(25.49)×1÷10 = - $17.00

These are the calculated swap charges for holding each position for one day, considering the same example which is meant to be for Wednesday, then we need to calculate for three days.

Swap Charges=Volume*Pip Value *(Swap Rate)* a number of days ÷ 10 = $17.00

Swap Charges=1.00×6.67×(25.49)×3÷10 = - $51.00

Note: Wednesday Swap rates are three times higher than the normal days

As a Result:

- Understanding swap charges is crucial for traders to effectively manage their positions and optimize their trading strategies.

- By considering swap charges as part of their risk management approach, traders can make informed decisions about holding positions overnight.

- Real-time examples demonstrate how swap charges can impact different trading scenarios, highlighting the importance of factoring them into trading analysis.

- Overall, swap charges reflect the interest rate differentials between currencies or commodities and play a significant role in the overnight financing costs or earnings for traders in the financial markets.

By incorporating these explanations and real-time examples, traders can gain a better understanding of how swap charges occur and their implications for trading strategies and performance.