Introduction:

In the realm of technical analysis in financial markets, traders are constantly on the lookout for reliable patterns that can indicate potential shifts in market sentiment and direction. One such pattern that has garnered significant attention among traders is the engulfing bar pattern. Engulfing bars are powerful candlestick patterns that can provide valuable insights into market dynamics, offering traders opportunities for profitable trades. In this comprehensive guide, we'll delve into the intricacies of engulfing bar trading and explore effective strategies to master this technique.

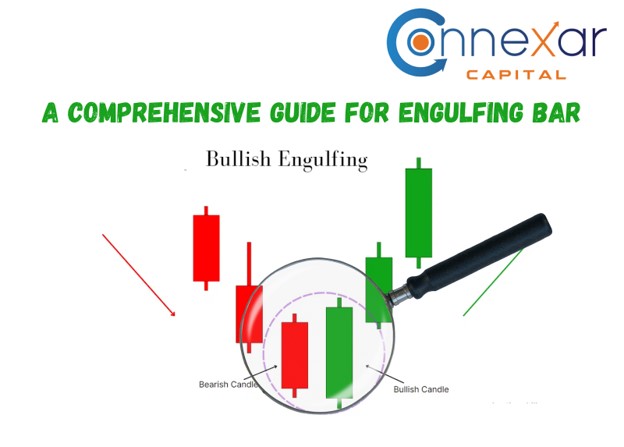

Understanding the Engulfing Bar Pattern:

The engulfing bar pattern is formed by two consecutive candlesticks, where the body of the second candle completely engulfs the body of the preceding candle. There are two types of engulfing patterns: bullish engulfing and bearish engulfing.

Bullish Engulfing Pattern:

Occurs during a downtrend.

The first candlestick is bearish, followed by a larger bullish candlestick that engulfs the entire body of the previous candle.

This signifies a potential reversal in the prevailing downtrend, indicating buying pressure and a shift in market sentiment from bearish to bullish.

Bearish Engulfing Pattern.

Forms in an uptrend.

The first candlestick is bullish, followed by a larger bearish candlestick that engulfs the entire body of the preceding candle.

Indicates a potential reversal in the ongoing uptrend, suggesting selling pressure and a shift in sentiment from bullish to bearish.

Key Elements of Engulfing Bar Trading.

Confirmation:

Engulfing patterns are more reliable when accompanied by other confirming factors such as support/resistance levels, trendlines, or technical indicators like moving averages or oscillators.

Wait for the engulfing pattern to be confirmed by these additional signals before entering a trade.

Volume: Pay attention to trading volume when analyzing engulfing bars. Higher volume during the formation of the engulfing pattern reinforces its significance and increases the probability of a successful trade.

Timeframe: Engulfing patterns can be observed across various timeframes, from intraday charts to daily and weekly charts. Consider the timeframe that aligns with your trading strategy and objectives.

Risk Management:

Implement proper risk management techniques, including setting stop-loss orders to limit potential losses and adhering to risk-reward ratios to ensure favorable trade outcomes.

Trading Strategies Using Engulfing Bars.

Engulfing Bar Reversal Strategy:

Wait for a bullish or bearish engulfing pattern to form at key support or resistance levels.

Enter a trade in the direction opposite to the previous trend once the engulfing pattern is confirmed by other indicators.

Set stop-loss orders below the low of the bullish engulfing candle or above the high of the bearish engulfing candle.

Engulfing Bar Continuation Strategy:

Look for bullish engulfing patterns in an uptrend or bearish engulfing patterns in a downtrend.

Enter trades in the direction of the prevailing trend after the engulfing pattern is confirmed, aiming to capitalize on the continuation of the trend.

Use trailing stop-loss orders to protect profits as the trend progresses.

Conclusion:

Engulfing bar trading is a versatile and effective technique that can enhance your trading arsenal when used correctly. By understanding the dynamics of engulfing patterns and implementing sound trading strategies, you can identify high-probability trade setups and capitalize on market opportunities with confidence. Remember to combine engulfing patterns with other technical tools and exercise prudent risk management to maximize your trading success. With practice and experience, mastering engulfing bar trading can lead to consistent profits in the dynamic world of financial markets.